There are people out there at trading houses, financial institutions and all sorts of media providers called analysts. What they do all day is analyze the market, the data (external and internal) and come up with actionable insights. Hence analysis deserves a dedicated role on its own, and is closely linked to research, which again is something you could do full time.

Yet here we will talk about different type of analysis. Perhaps a simplified but at the same time more pragmatic form of analysis that you can apply to your physical trading routine. Truth to be told, analysis is an integral part of trading. You need to understand and to try to foresee the market behaviour in short/mid and long term to take action and trade. We do not talk here only about position taking. Even if you stick to back to back arbitrage in the spot market, you still will not be able to avoid some analysis in order to simply identify those arbitrage opportunities.

If you are not much of an intellectual type (you do not need to be an intellectual to succeed in business), and reading bores you (I personally adore reading), focus at least on physical supply & demand situation.

How could you do it?

For the reason of simplification let us assume you trade a niche minor metal, which 80% of supply comes from 2 countries only (if it is a minor metal, you can bet your head that in just about any scenario one of these countries will be China). If it is possible look at stocks available – meaning all the metal that is already there on the market (kept in producers’, consumers’, traders’ and exchanges’ warehouses) – it could be in form of data coming from exchange, from government or from information providers – now lucky you if you find such data for minor metals, but remember it just an example to teach you an approach that shall be somehow valid to all commodities classes.

Once you have this data, you shift your attention to the supply side. Analyzing supply and demand side, works at different levels of granularity. You can take a macro perspective and read all sorts of reports, starting from government agency reports in the country of interest (might be there but in local language, not easily accessible even if publicly disclosed), globally oriented government reports (for metals do have a look at excellent USGS reports), all sorts of research & analysis published by the medias and researchers. Yet at the same time it is not difficult to discern who are the major producers for given commodity, how many producers there is in total and approach them one by one. Build a relationship – as in case of all other counter parties in commodity market it will be give & take. The ultimate representation of fruitful give and take are numerous successful deals closed. Yet even if you can not close the deals, you still trade in information. Physical markets for many commodities are not really transparent. So information is not just a curio, it does have a commercial value.

Ok, so what information you want to get from producers? A key questions that you may ask include:

1. What is your capacity for this year?

2. Do you plan to use/are using full capacity?

3. Do you have your production allocated for long term deals? Or do you sell on spot market?

4. What is your price idea?

5. How do you see the market in the short/mid/long term?

6. Do you allocate a production on domestic market? If so do you see a threat of imports?

7. In what jurisdictions/markets you have build relationships/exclusive distribution agreements?

8. What new markets are of interest to you? Maybe we could help you to get a foothold in the market?

Obviously such information is sensitive, it is given in confidence, in exchange of already secured or expected economic benefit. Be subtle, do not be intrusive, think what is in it for them?

Once you have such questions answered by major producers in the market, you analyze it, you crunch some numbers and effectively you may obtain a better market view than some full time analysts may have.

You assume a similar approach and similar type of questions with major end-consumers of your commodity – for instance industrial plants, manufacturing components for larger more publicly visible industries (in commodities sometimes you need to go deep into the value chain to find out who is really buying a commodity – if you think you can sell lithium to electric car manufacturers, or battery makers think twice, sometimes you can but sometimes they may be surprised, if you come cold calling them out of the blue)

In case of consumers, remember you talk to potential new clients. You need to struck the right cords from the very beginning. Market info is of value sure, but most importantly you need to find out about their needs.

Possible questions you may want to ask, include:

1. What are your price ideas?

2. Do you think market now is in contango, backwardation or just flat?

3. Do you buy on spot or you have all your needs secured?

4. Are you interested in any long term deals?

5. Are you using a full capacity for production ?

6. What is the outlook for the industry this year? Is demand strong?

7. Is there any off-spec material you could be interested in? (at better price than in-spec)

8. What origins do you buy?

I think the logic behind most of these questions is self-explanatory.

Yet some require certain clarification:

If capacity is not used at full, it may imply that producers do not really see the strong demand in near future or that they already keep high stocks.

Market in contango is when spot (current) price is lower than a future price (for instance a month from now)

Backwardation means an exact opposite. Spot price is higher than a future price.

Contango is more usual situation – just think about the storage costs, costs of money (interest rates on borrowed capital that you keep frozen), and plain uncertainty of making a sale.

Price idea – is a well known and used term – it is an estimated price (unlike bid and an offer) so don’t hold people up to the price idea they gave you…

Off-spec – commodities are traded accordingly to certain specification (usually chemical composition). There are certain standards specs for commodities typically traded. Value (price) of commodities is directly linked to their specs. Lead with 99.9 % of lead contained and rest containing different impurities (could be for instance tiny, tiny bits of copper, arsenic and other possible elements) costs more per tonne than lead with 99.7% of lead contained and the rest being impurities). Depending on technological processes employed by consumers, some plants can tolerate certain impurities more and some less.

So a commodity containing too high level of sulphur than a standard dictates can be useless for one plant (trash, could spoil their precise machinery) for others is tolerable.

Hence what you do, you buy what some consider as trash for half a penny and flog it to consumers which will be happy to pay for it lower price than they would pay for in-spec material, yet enough for you to still make a handsome margin.

With all this information, a picture of a market emerges, with possible imbalances in sight. Again, view of the market as a whole, with supply, demand forces and stocks in place might be assumed with certain level of granularity.

You can see it at global, regional and local level. Maybe global market is in over-supply for a given commodity, yet in Bangladesh there is a strong demand, and consumers are hungry for the product? Naturally it constitutes an arbitrage opportunity for you.

It is also of immense importance to look at reports on state of industries buying your commodity. Strong foreseen CAGR (Compound Annual Growth Rate) is perhaps good positive indicator for stronger demand and growing market size.

Search for reports coming from established consultancies as BCG, Accenture, major financial institutions or small agile research companies specialized in their niche.

Freight plays an immense role in commodities markets, as I have mentioned in the previous 101 article.

Follow the freight rates. They are available in form of indexes (Shanghai Containerized Freight Index , Baltic Dry Bulk Index), for containers and bulk. They can give you a rough idea on the state of the market.

If you want exact rates go and contact your logistics provider/shipbroker.

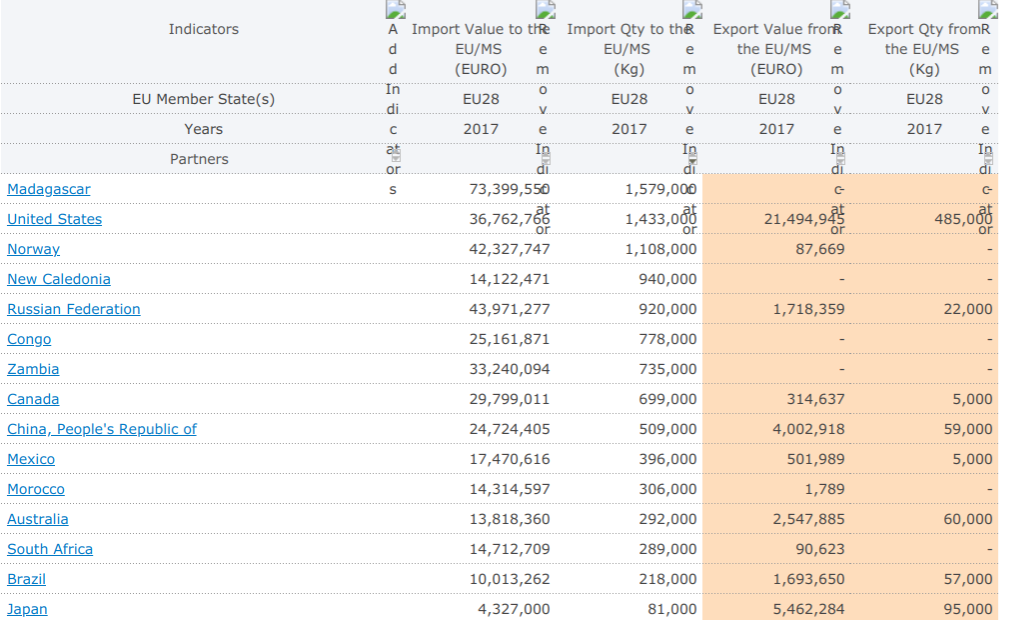

You also need to get well oriented in trade flows in between borders. EU provides excellent customs statistics free of charge.

Below you could see a result of query, effectively showing top origins for cobalt imports to EU in 2017. You can sort it by quantity, value et cetera.

source: madb.europa.eu

Very valuable resource, just be confident you use a correct customs code and make sure you understand what it compromises (it may compromise more than what lies in your interest even if these codes tend to be quiet narrow..)

Another important factor are currency rates. To great extent arbitrage in commodities includes buying form energing markets and selling in developed ones (however this is really far from being a rule). Exchange rates of emerging market currencies are particularly volatile.

Just look at volatility of exchange rates between USD and CNY:

source: xe.com

Be sure to hedge you currency exposure for long term deals or just stick to buying and selling in USD (it is super common).

Even if you do your deals in Dollars, remember of the impact of fluctuations which is still there. As the currency weakens producers are usually eager to export at lower prices. After all they tend to have most of their input costs in local currency.

Learn more about market analysis from the perspective of commodity trader in our course.